Sierraeye: What do you think about the Bank Governor’s handling of the economy?

Rodney Michael: I have reservations about the Bank Governor’s handling of the economy. He is too theoretical than practical. Due to the prevailing business atmosphere, he must understand that the economy is informally controlled.

Sierraeye: How?

Rodney Michael: The more you make it difficult for the formal sector, the more you weaken it and strengthen the informal sector. For the private sector, for example, to acquire loans through the formal means is very difficult; the process is too long, and the conditions are very stiff. However, getting credit from the informal sector is much easier, swift, and less hassle-free. Business people will go for loans in the informal sector even if it implies paying a much higher interest rate.

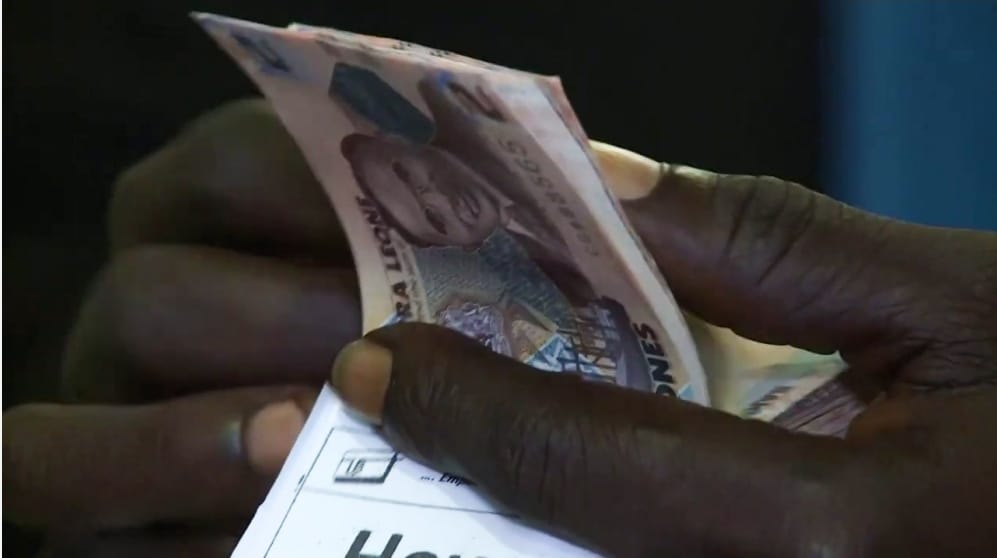

Sierraeye: Do you have reservations about the redenomination of the Leone?

Rodney Michael: Yes. I have. The redenomination is intended to restore confidence in the Leones. For it to work, you must put in place structures that will give that confidence.

Sierraeye: What are the structures?

Rodney Michael: The Bank Governor must ensure that there are enough new Leones in the market for all to access it. Cash restriction was a bad policy; instead of restoring confidence, it created panic and a lack of confidence.

Sierraeye: Did the Bank Governor ensure that the structures were in place?

Rodney Michael: No. He did not ensure that structures for confidence building were in place. The reversal of his decision and reintroduction of the old Leones into the market was a clear manifestation that the necessary structures were absent. Concerns were also raised when he introduced the old Leones about whether the Leones were printed. The extension of the deadline for the old Leones to go out of the market indicates that the Bank Governor was not well prepared. When you print new notes, you have to consider the exchange rate difference at the time of the printing and accommodate the increase of the cash in the market based on the current exchange rate.

Sierraeye: Did the Bank of Sierra Leone make provision for the exchange rate deficit?

Rodney Michael: I don’t think the Bank of Sierra Leone made provision for the huge exchange rate deficit before the circulation of the new Leones, and as such, the market required more physical cash since our economy is cash-controlled. The shortage of the new Leones also affected consumer confidence. There are also several factors that coincided with the new Leones.

Sierraeye: What are these factors?

Rodney Michael: Incredible amounts of revenue generated, for instance, through the informal sector, cannot be accounted for nor easily estimated, neither can the amount be easily determined. The revenue is generated through illegal businesses, drug trade and corruption, whose funds are used to strengthen the informal sector. Before 2008, however, the banking sector was a doable creditor for the private sector.

Sierraeye: How do you contrast the past to the present regarding lending and borrowing from the formal and informal sectors?

Rodney Michael: Today, for a quick turnover, brisk business and quick profit, the private sector prefers soliciting credits from the informal sector irrespective of the higher interest rate or commission they might pay. All this occurs because the formal sector (the banking sector) is now restricted with stringent conditions to authorise credits despite adequate security being made available. For several reasons, controllers of the informal market would prefer to keep their money in foreign exchange rather than the Leones.

Sierraeye: What are the reasons?

Rodney Michael: Foreign exchange is easier to keep at home than the Leones. Revenue from the informal market is mostly through illegal means. Consequently, there will be an obstacle to the banking sector. Because the informal sector has been allowed to go so strong and make so much profit, and especially those acquiring their funds through the trading of drugs and illegal substances as well as corruption, they can afford to buy foreign exchange practically at any price. This is why many would think the new Leones is responsible for the exchange rate hike. But, in reality, the exchange rate hike is caused by the lack of confidence in the formal sector, allowing the informal sector to take absolute control of the economy.

Sierraeye: What can you say about the restriction of the US dollars?

Rodney Michael: Restriction of the US dollars affects confidence in the economy and creates artificial scarcity as many were afraid to expose the amount of cash foreign exchange they have in their possession. An economy like ours does not need very stringent rules and regulations.

Sierraeye: Why?

Rodney Michael: The economy is much cash-related, so we need to encourage easier trading opportunities like we had in pre-2008 under President Ahmed Tejan Kabba. Even if it is misconstrued that they were encouraging the dollar as the second currency.

Sierraeye: Is the foreign currency restriction a mistake by the Bank Governor?

Rodney Michael: It was a big mistake as everyone lost confidence. Owing to the restriction, nobody could withdraw beyond NLe 30,000 (thirty thousand New Leones). People will run away when you come up with such restrictions. The other mistake was that they tended to think the new Leones was hoarded. It was not hoarded; the only thing, the people need cash because the economy is cash-controlled. It is only foreign currency that the people will board.

Sierraeye: What is the effect of the Bank Governor’s mistake?

Rodney Michael: The banking sector became weaker because there was no other money to credit people.

Sierraeye: What is your general understanding of inflation in Sierra Leone?

Rodney Michael: There is inflation in the country because the Leone is weak in the face of the dollar. If, for example, you import 95% of your commodities, and the Leone has lost its value against the foreign exchange; naturally, you can have inflation equivalent to the exchange rate difference.

Sierraeye: What measures will you suggest to the government to reduce inflation in the country?

Rodney Michael: To control inflation, the government must control the exchange rate and stabilise prices. There is no easy solution since we import more than we export. In such a situation, the demand for foreign currency is far greater than we can generate.

Government must think out of the box and think about unconventional ways of generating revenue to ease the pressure. Sierra Leone could learn from neigbouring Guinea, where the export of gold minerals carries a minimal charge far less than what we charge on the gold export. The foreign exchange must come through the banking sector to encourage more export from Sierra Leone.

Government must encourage investors, tourists and diasporans to come into Sierra Leone with either cash foreign exchange or a transfer of foreign currency through the banking sector for use in Sierra Leone. Economy-wise, President Ahmed Tejan Kabba survived because there were no tight restrictions although he took over governance when the country had nothing. Bio had a golden opportunity, but the Bank Governor is messing him up.

Government must also ensure the availability of foreign exchange in the banking sector at all times for those within the formal sector and the public at large through legitimate means.

Sierra Leone should revert to pre-2008 economy where contractors and business people were paying foreign exchange and could trade among themselves in foreign exchange.

Also, individuals could keep foreign exchange in their bank accounts and use such foreign exchange to pay for services, facilities, bills, or even sell to business entities, and could freely withdraw to sell to the banks. This allowed for more foreign exchange through the formal sector.

There should be much more encouragement for factories to produce locally, especially where our raw materials are mined, like iron ore, as is done in Ghana. This will bring more foreign exchange to the country.Government should never subsidise since it is not a pro-poor policy. The largest fuel consumers are not the poor but the middle and upper class.

Sierraeye: Will there be no impact on the poor if the fuel is left unsubsidised?

Rodney Michael: The impact on the poor is far less than those benefiting from the subsidies.

Sierraeye: How?

Rodney Michael: The impact on the central budget is far greater than the benefit derived by the poor. Frequent fuel shortages are brought about by restricting the government’s power to control the commodity. However, the government’s current effort, through Petroleum Regulatory Agency, in working with fuel importers to monitor the global market and support them with foreign exchange as best as possible at a lower rate is the right step in the right direction. Such a move helps keep in check the domestic cost of fuel. The result of which is the recent reduction in fuel prices.